Comprehensive profile of a successful CFO

Madrid, Spain – A Chief Financial Officer or CFO must have a strong set of hard skills – technical and analytical competence – and soft skills, such as strategic communication, commercial, interpersonal, and managerial competence.

The title represents a functional position that supports the business, and for which knowledge and experience of the industry is critically important. Nowadays, companies demand a more aggressive profile that works in project cycles of 4-5 years, consistently implementing changes and achieving results.

In this report, we will analyse the position from the perspective of the CFOs as they see themselves, the organisational schemes in listed and unlisted companies, and the factors that affect the remuneration of a CFO.

The Financial Department is a strategic area. A CFO’s remuneration level varies according to the complexity and size of the company, ranging from 90,000 Euros for small companies to over 400,000 Euros for listed companies

HOW CFOs PRESENT THEMSELVES

The CFOs use their resumes to emphasize their technical skills and responsibilities above any other personal and sectorial details. However, they often also omit important soft skills required for the position. Based on numerous resumes, we can summarise their areas of responsibility as follows:

- Accounting: managing the accounting and administration department;

- Budget control: producing investment and operational budgets at regular intervals for efficient decision-making;

- Management control (measurement): establishing a dashboard with key performance indicators for business monitoring and decision-making;

- Treasury: managing working capital (liquidity, collections and payments, short-term debts);

- IT: Designing and promoting the implementation of computerized management systems;

- Relationship with banks: managing and using financial resources to achieve the company’s general objectives, optimising performance by negotiating terms with banks and financial institutions;

- Evaluating and reporting on investment and financing options, with clear criteria;

- Close collaboration with the Human Resources and Information Systems departments;

- Participating in the establishment and amendment of company policies and procedures;

- Optimising organisation, production planning and services in general, including administrative and control rules where relevant;

- Participating in the general management of the company as a board member;

- Investment analysis;

- Sustaining relationships with analysts and investors;

- Identification, analysis and valuation of growth alternatives through acquisitions.

WHAT DO COMPANIES DEMAND FROM THEIR CFOs

In recent years, risk assessment, compliance, audit, and corporate governance have become extremely important. These new demands have significantly impacted the profile of the CFO sought by companies. Subsequently, soft skills have become just as important as hard skills, if not more. The latter can be outsourced to experts who keep their skills and training up-to-date, but soft skills cannot be outsourced. The CFO needs to be a good communicator and a commercial visionary in order to sell company attributes to the stakeholders – investors, auditors, consultants, advisors, regulatory bodies, fund providers, and employees. Additionally, the CFO has to be a good manager, as the function has increased the level and extent of its responsibilities.

In many cases, particularly in family-owned businesses, the financial director is also responsible for the management of Human Resources and Information Systems. There are organisations that list supply chain, quality assurance, risk evaluation and compliance as the duties of the CFO.

Our personal interviews with CFOs have given us valuable information about their personalities, skills and abilities. After more than a decade interviewing CFOs, we can conclude that in addition to analytical skills, a successful CFO must have a structured mind, excellent interpersonal and communication skills, a balanced personality, high working capacity, strong service attitude, and excellent coordination skills. Finally, sector experience is very important. These capabilities become more important as the company becomes larger and more complex.

THE CFO IN A LARGE CORPORATION

When we refer to large corporations, we do so from the perspective of their headquarters. Factors that add complexity to the company and directly affect the function of the CFO include: shareholder composition (e.g. institutional or retail shareholders, free float, degree of concentration, international sections, board representation), organisational structure (e.g. matrix, geographical, by business units, by product, hierarchical or horizontal), the presence of a venture capital investor among the shareholders, investment capacity, growth opportunities through acquisitions, audits, compliance, corporate governance and the management and alignment of subsidiaries. For a listed company, the complexity is much greater because of the need to inform markets, regulators, supervisors, and other stakeholders.

The CFO of a large corporation must produce financial forecasts that contemplate multiple possible future scenarios. Moreover, management audit and oversight should include qualitative indicators that take the position of competitors into account, treasury management must be efficient in order to obtain the maximum economic yield, and last but not least, the relationship with analysts and investors must be fluent and planned to obtain the necessary credibility and the confidence of the financial system.

THE ORGANISATIONAL STRUCTURE OF THE FINANCIAL DEPARTMENT

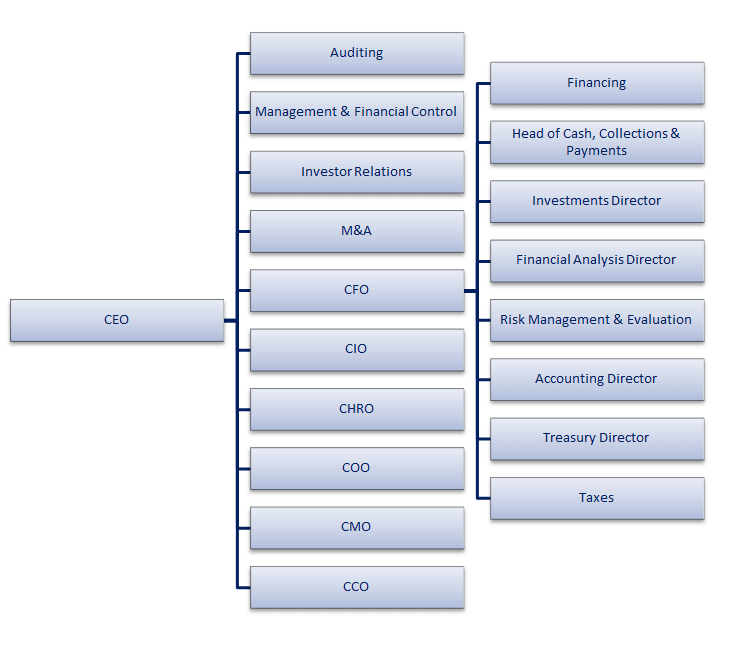

The organisation chart of the Financial Department of a large listed company includes Budgets, Financial Analysis, Accounting, Investors Relations, and Treasury, with all of these areas reporting directly to the CFO. However, the General Manager or CEO is responsible for Management Control and Audit (and occasionally, the M&A Division, if it exists).

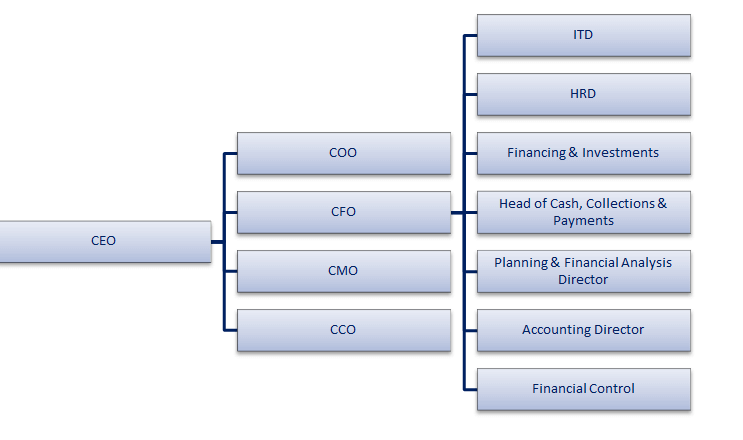

Smaller unlisted companies may incorporate HR and IT into the Financial Department.

In Banking, it is usual to have a specific division that encompasses all the back office areas. Because of the unique nature of the sector, the Financial Department is outside this division, and reports directly to the CEO.

Depending on the sector and the size of the company, the area of Management Control may either be within the Financial Department or outside it, reporting directly to the CEO

Graphic 1: Centralised CFO. Large Company

Graphic 2: Decentralised CFO. Large Company

Graphic 3: CFO Midsize Company

The organisation chart of an unlisted midsize company is much simpler. They do not need to inform the markets as frequently, and the CFO assumes many functions that are separated in large companies. For example, the Mergers & Acquisitions, Audit and even Management Control functions will be carried out directly by the CFO, and there is no Investor Relations division. Smaller companies and family-owned businesses sometimes incorporate HR and IT into the Financial Department.

RELEVANCE OF THE SECTORAL BACKGROUND

We have seen how the size of the company influences the CFO’s profile. In addition, it is also important for the CFO to have experience in the same sector, or a closely-related one. A company that provides services may have very little in common with a company that manufactures products, and the same is often true for a B2B company compared to a B2C company.

Factors such as the capital structure, level of indebtedness, working capital, capex, typology of investors, financial planning, corporate structure, and international organisation can differ widely.

Imagine a steering committee meeting that is attended by the General Manager and the Commercial, Operations, Marketing, and Financial Directors. If the CFO does not have extensive experience in the industry, his analysis will not be valued or heard by other committee members, especially with regard to issues related to the company’s product, strategy or business. However, if he knows the business well, his analytical capacity and level of information place him in an unbeatable position to provide key business indicators for decision-making.

REMUNERATION

In general terms, we find that CFOs have a compensation structure consisting of a fixed part and a variable part. Usually, the CFO’s variable part is smaller than for other positions such as General Manager or Commercial Manager, and is usually somewhere between 20-30% of the fixed salary. This percentage persists independently of the size of the company.

However, the fixed remuneration varies greatly depending on the size of the company. In midsize companies, the salary is usually within 90,000-110,000 Euros, while in large listed companies the salary is likely to exceed 400,000 Euros.

Significant differences are also seen in CFO incentives and long-term remuneration. The standard incentives are life and health insurance, a company car and a pension plan. The long-term remuneration does not always depend on the size of the company, but may relate more to the company’s growth or the sector and usually consists of stock options plans or equity. For example, companies owned by private equity funds tend to provide substantial long-term incentives in order to attract CFOs from large companies.

The following chart presents the results of a recent salary study. This study is of great interest, since it reveals significant differences in the remuneration of the CFOs of large and small companies. For example, the salary of a 36-year-old CFO in a listed company is about 55% higher than for a CFO of the same age in a small company. The age of the CFO also makes a difference; in unlisted midsize companies, the salary gap between a CFO of 36 and a CFO of over 50 is 43%.

Chart 1. CFO Salary Ranges

Pedersen & Partners is one of the fastest-growing, fully integrated Executive Search firms worldwide; it is 100% owned by its partners who all work full-time to serve its clients. The firm celebrated its 15th anniversary in January 2016, and to mark this occasion, it has created a timeline web page, featuring key milestones for the firm’s development and has released an anniversary video.

Alvaro Arias Echeverría is the Partner in charge of Iberia and Latin America at Pedersen & Partners. Mr. Arias Echeverría brings over 15 years of Executive Search experience, having successfully completed Executive Search assignments across Europe and Latin America with a particular focus on Retail, FMCG, Financial Services, Health, and IT. Prior to joining the firm, Mr. Arias Echeverría held senior positions as a Partner and member of the International Executive Committee of an international Executive Search firm based in Austria. Earlier in his career, he was a Principal with a world-leading Executive Search firm based in Switzerland and Senior Manager at AT Kearney. He was also Professor at IESE Business School where he founded and led its International Finance Research Centre in Barcelona and Madrid.

Alvaro Arias Echeverría is the Partner in charge of Iberia and Latin America at Pedersen & Partners. Mr. Arias Echeverría brings over 15 years of Executive Search experience, having successfully completed Executive Search assignments across Europe and Latin America with a particular focus on Retail, FMCG, Financial Services, Health, and IT. Prior to joining the firm, Mr. Arias Echeverría held senior positions as a Partner and member of the International Executive Committee of an international Executive Search firm based in Austria. Earlier in his career, he was a Principal with a world-leading Executive Search firm based in Switzerland and Senior Manager at AT Kearney. He was also Professor at IESE Business School where he founded and led its International Finance Research Centre in Barcelona and Madrid.

Pedersen & Partners is a leading international Executive Search firm. We operate 56 wholly owned offices in 52 countries across Europe, the Middle East, Africa, Asia & the Americas. Our values Trust, Relationship and Professionalism apply to our interaction with clients as well as executives. More information about Pedersen & Partners is available at www.pedersenandpartners.com

If you would like to conduct an interview with a representative of Pedersen & Partners, or have other media-related requests, please contact: Diana Danu, Marketing & Communications Manager at diana.danu@pedersenandpartners.com